The new SNAP work requirements for 2026 are a renewal and expansion of long-standing federal rules aimed at Able-Bodied Adults Without Dependents, often called ABAWDs. In simple terms, these rules say that most adults in this group must work or participate in approved activities for a minimum number of hours each month to keep receiving benefits beyond a short time limit.

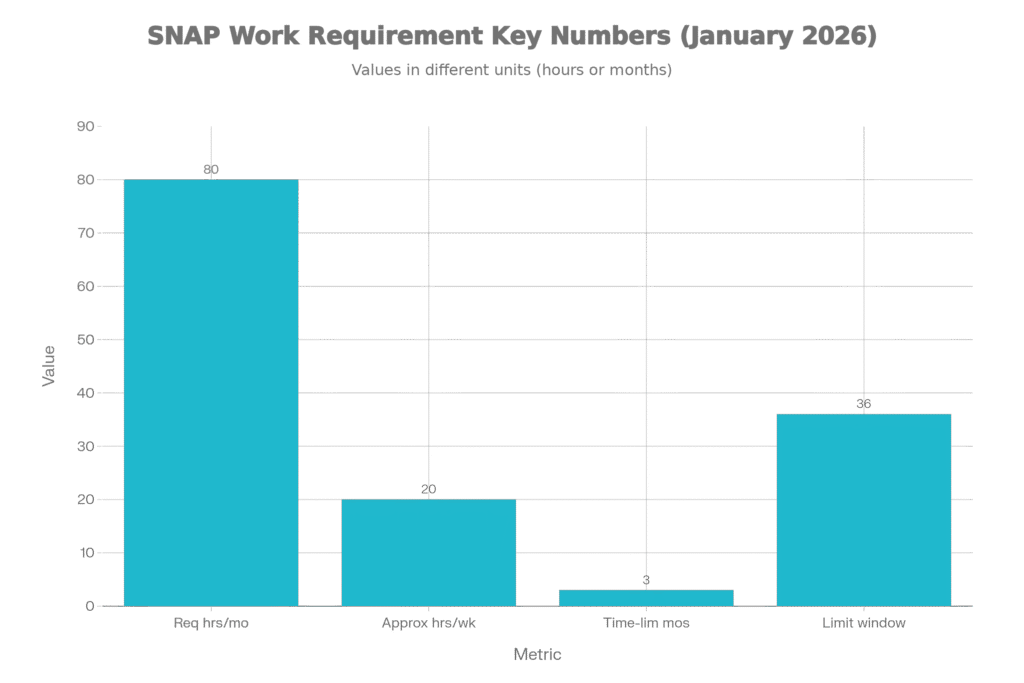

Under the updated framework, ABAWDs must generally meet an 80‑hour per month participation standard. Those hours can come from paid employment, self-employment, approved job training, workfare assignments, or certain types of volunteer work. The key idea is that SNAP is being tied more clearly to ongoing engagement in the labor market or work-related activities, instead of being available indefinitely to adults who are considered able to work but not doing so.

Table of Contents

New Work Requirements for SNAP Starting January 2026

| Key Detail | What It Means In 2026 |

|---|---|

| Target Group | Able-Bodied Adults Without Dependents (ABAWDs), generally adults around 18–64 with no dependent children on their SNAP case. |

| Core Requirement | At least 80 hours per month of work, approved training, volunteering, workfare, or a combination of these. |

| Time Limit | If the requirement is not met and no exemption applies, benefits are limited to 3 months in a 36‑month period. |

| Rollout Timeline | Full and consistent enforcement expected nationwide from late 2025 into early 2026, after years of waivers and partial application. |

| Main Exemptions | People who are medically unfit to work, pregnant, primary caregivers, some veterans, people experiencing homelessness, and certain qualifying students. |

| State Flexibility | States can grant a limited number of discretionary exemptions, up to a capped share of their ABAWD caseload. |

| Documentation | Recipients must report hours and changes on time; states must track participation and send written notices before cutting benefits. |

What’s Changing and Why Now

Work rules tied to SNAP are not brand new; they have existed in federal law for years, but were softened or waived widely during the pandemic and in earlier periods of high unemployment. As conditions stabilized, USDA began moving back toward strict enforcement and is now pushing states to fully apply the law by early 2026. The goal, from the government’s perspective, is to ensure that food assistance supports work rather than replaces it when people are able to participate in the labor market.

Critics, however, worry that this shift will hit people with unstable schedules, part-time jobs, or limited access to transportation the hardest. Many SNAP recipients already work, but their hours may fluctuate from month to month. If their documented hours drop under 80 or paperwork is submitted late, they could be counted as “noncompliant” even while doing their best to stay employed. This tension between accountability and access is at the heart of the current debate.

Who Is Considered An ABAWD

To understand if the new rules may apply to you, it helps to know what counts as an Able-Bodied Adult Without Dependents. In general, an ABAWD is:

- An adult in roughly the 18–64 age range

- Not living with and responsible for a dependent child on the SNAP case

- Considered physically and mentally able to work

If you are caring for a young child, receiving disability benefits, or medically certified as unable to work, you are typically not treated as an ABAWD. But if you are a single adult or living with others without being responsible for a dependent child on the case, there is a good chance you may fall into this category once the new SNAP work requirements for 2026 are fully in force.

The 80‑Hour Per Month Standard

The central rule for ABAWDs is the 80‑hour participation requirement. This does not have to be a full-time job with one employer. Instead, hours can be built from:

- Regular part-time or full-time work

- Self-employment that can be reasonably documented

- Participation in a SNAP Employment & Training (E&T) program

- Assigned workfare activities through the local agency

- Certain approved volunteer or community service roles

As long as the total reaches at least 80 hours in a given month and is properly reported, the work requirement is met. Where many people run into trouble is not the work itself but the tracking missing paperwork, late reporting, or confusion over which activities count. With the new SNAP work requirements for 2026, states are under pressure to document participation more carefully, which makes it even more important for recipients to keep their own records.

The Three‑Month Time Limit

If you are subject to the ABAWD rules and do not meet the 80‑hour standard, you are limited to three full months of SNAP benefits within a 36‑month “clock.” Once those three months are used, benefits can stop. You do not have to receive three months in a row; any month in which you get benefits without meeting the requirement can count against your limit.

You can usually restart benefits by either meeting the work requirement for a specified period (for example, 30 consecutive days of compliant hours) or by newly qualifying for an exemption. The important point is that simply waiting does not fix the issue; you need a change in status or documentation that shows you now meet the rules.

Exemptions From the New Work Requirements for SNAP Starting January 2026

Not everyone is expected to satisfy the new SNAP work requirements for 2026. Common exemptions include:

- People with a documented physical or mental health condition that limits their ability to work

- Pregnant individuals

- Primary caregivers for a child or an incapacitated household member

- Certain veterans and people experiencing homelessness

- Some students enrolled in qualifying education or training programs

If you think you might qualify for an exemption, it is vital to tell your local SNAP office and provide any paperwork they request. Many people lose benefits not because they are actually required to meet the ABAWD standard, but because their exemption status was never properly recorded. States also have a limited pool of “discretionary exemptions” they can assign based on individual circumstances, but these are capped. That means they may be reserved for especially vulnerable cases.

How States Are Implementing the Changes

SNAP is a federal program administered by states, so the overall rules are the same nationwide, but the experience on the ground can differ. Some states already enforce ABAWD rules strictly and have systems in place to track hours and send alerts. Others are still updating software, training staff, and building partnerships with workforce and community organizations.

As the new SNAP work requirements for 2026 take hold, states are expected to:

- Identify everyone who falls into the ABAWD category

- Notify them clearly about the upcoming changes and their obligations

- Offer information on employment, training, or volunteer options that can count toward the 80‑hour requirement

- Track compliance month by month and apply the three‑month time limit when necessary

Because of this, you may see more letters, texts, or portal messages from your state agency. Responding to them quickly can prevent surprises later.

Practical Steps For SNAP Recipients

If you think you might be affected by the new SNAP work requirements for 2026, here are some practical steps:

- Contact your SNAP caseworker or local office and ask directly whether you are considered an ABAWD.

- If you have health issues, caregiving responsibilities, or other factors that might exempt you, gather documentation and submit it early.

- If you do not qualify for an exemption, ask about SNAP Employment & Training programs, local job centers, and volunteer opportunities that count toward the 80‑hour standard.

- Keep copies of pay stubs, schedules, and attendance sheets, and note your hours each week so you can report accurately.

- Watch your mail and any online portal your state uses; missed notices are a common reason people lose track of their time limit.

By treating the new SNAP work requirements for 2026 as something to plan for rather than fear, you give yourself the best chance to stay eligible and avoid gaps in your food assistance.

New York Inflation Refund Checks 2025: Up to $400 Relief Payments Explained

Balancing Policy Goals and Real Life

- Supporters of stricter work requirements believe they encourage workforce participation and reduce long-term dependency on benefits. Opponents point out that food security is a basic need and that job markets, health, transportation, and caregiving demands are not always within a person’s control. In practice, the success or harm of these rules will depend heavily on how states and local agencies implement them—and on whether recipients receive clear information, fair treatment, and real opportunities to meet the 80‑hour standard.

- For now, the most important thing is awareness. If you or someone you know could be classified as an ABAWD, learning how the new SNAP work requirements for 2026 operate and what options exist to comply or claim an exemption can make the difference between a sudden loss of benefits and a manageable transition under the new rules.

FAQs on New Work Requirements for SNAP Starting January 2026

1. Who will be most affected by the new SNAP work rules in 2026?

The group most affected will be Able-Bodied Adults Without Dependents generally adults around 18–64 who are considered able to work and do not have dependent children on their SNAP case.

2. Do I have to work exactly 80 hours in a paid job to keep my benefits?

Not necessarily. The 80‑hour requirement can be met through a mix of paid work, approved job training, qualifying volunteer work, or workfare.

3. What happens if my work hours change from month to month?

If your hours drop below 80 in a given month and you are not exempt, that month can count against your three‑month limit.

4. How can I find out if I qualify for an exemption?

You should contact your local SNAP office and explain your situation in detail health conditions, pregnancy, caregiving duties, housing status, or student status.