If you’ve been seeing headlines about a big cash boost titled IRS Confirms $1390 Direct Deposit Payments, you’re not the only one wondering if this money is real and whether your bank account is on the list. The amount sounds specific; the graphics look convincing and the timing after years of high prices and financial pressure feels perfect. That’s exactly why this topic is everywhere right now, and why it’s important to separate hard facts from wishful thinking and clickbait.

For many households, even a one‑time $1,390 deposit can mean catching up on rent, clearing an overdue bill or finally breathing a little easier at the grocery store. But before you re‑plan your entire month around it, you need to understand where the “IRS Confirms $1390 Direct Deposit Payments” narrative comes from, who it actually talks about, and what has and hasn’t been formally confirmed at the federal level. In many cases, what’s really being discussed is a mix of: earlier federal stimulus models, new political proposals and speculative reporting about what a next‑round payment could look like if Congress decides to act. That means the wording “IRS confirms” in the headline does a lot of heavy lifting, while the small print quietly admits that nationwide, automatic $1,390 deposits are not live law today. Keeping that difference clear is crucial if you want to avoid disappointment or, worse, getting pulled into a scam.

Table of Contents

IRS Confirms $1390 Direct Deposit Payments

| Point | What Viral Posts Claim | What You Should Realistically Expect |

|---|---|---|

| Program name | “$1,390 IRS stimulus” or “IRS Confirms $1390 Direct Deposit Payments” | A mix of proposals, rumors and speculative coverage, not one clear law |

| Payment amount | Flat $1,390 per eligible person, sometimes more for couples | Any real program may use sliding amounts, phase‑outs or different caps |

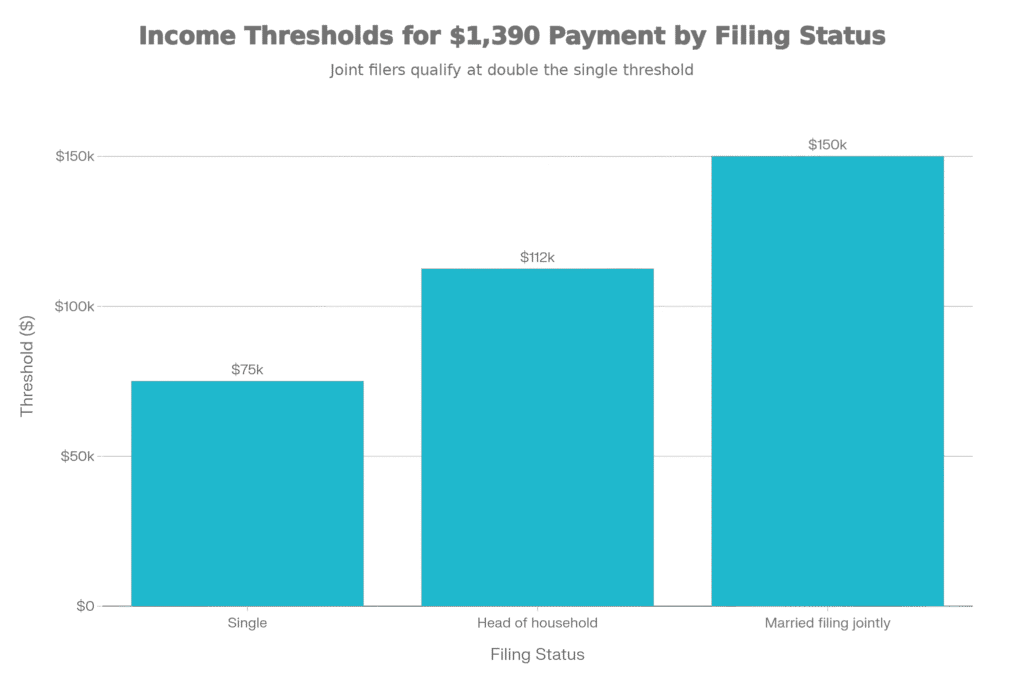

| Income limits | Figures like $75,000 (single) and $150,000 (married) frequently cited | These are borrowed from past stimulus; new rules would need fresh law |

| Target groups | Low‑ and middle‑income taxpayers, Social Security, SSI, SSDI, VA | True only if Congress explicitly writes them into a new relief package |

| Delivery method | Direct deposit first, then checks or prepaid cards | Realistic, but only after official enrolment and verification |

| Rollout timing | “This month” or “this week” in many headlines | Any real rollout would have a published schedule and clear dates |

| Official confirmation | Often implied, rarely linked | Needs clear documentation from Treasury, Congress and IRS |

| What you should do right now | “Sign up here” in some posts | Rely on official channels, not links in random messages |

What The $1390 Direct Deposit Payments Claim Actually Says

When you read beyond the first line, most detailed explainers describe IRS Confirms $1390 Direct Deposit Payments as a federal‑level relief idea aimed at families squeezed by persistent inflation, housing costs and medical bills. In that framing, $1,390 is pitched as a one‑time “pressure valve” designed to land quickly in the same way earlier economic impact payments did.

Those pieces often describe familiar mechanics: the IRS using your most recent tax return to calculate eligibility, automatically sending funds via direct deposit to the bank account on file and then following up with paper checks or debit cards for people without electronic details. The logic is sound because that’s how past payments were delivered. The catch is that those earlier programs were based on specific, passed laws until similar legislation is signed again, the current $1,390 concept remains just that: a concept.

Possible Eligibility Rules for $1390 Direct Deposit Payments If It Goes Ahead

Even though IRS Confirms $1390 Direct Deposit Payments is more of a trending label than a final program name, it’s still useful to look at how eligibility would likely be drawn up if such a payment ever moves from talk to reality. Lawmakers have a strong habit of reusing structures that worked before, especially when speed is a priority.

That means any real $1,390 payment would probably:

- Use your adjusted gross income from the latest processed tax year to decide how much you get, if anything.

- Apply full benefits up to a certain income level, then phase out gradually above that threshold.

- Treat single filers, married couples and heads of household differently, with amounts scaled to family size and dependents.

If seniors and disability beneficiaries are explicitly included, the back‑end data would likely come from Social Security and VA systems, with the IRS acting as the main payment engine. In that scenario, people who already get monthly checks or direct deposits for benefits may not need to file a separate application at all they would simply see the extra line show up in their usual deposit stream.

When Could $1390 Direct Deposit Payments Realistically Arrive?

- The most confusing part of the IRS Confirms $1390 Direct Deposit Payments story is timing. Various posts talk about August, September or November windows, sometimes changing the month while keeping the same graphics, wording and numbers. This kind of shifting timeline is a classic sign that the content is chasing clicks rather than tracking a firm legislative calendar.

- If a real law were passed, the rollout would follow a clear pattern: a signing date, a public implementation plan and then a staged payment schedule, usually starting with people who already have direct deposit information on file. First waves would likely land within a few weeks of approval, with later checks clearing for those with paper mail or extra verification needs. Without that kind of formal road map, any promised “exact date” for $1,390 deposits should be treated as marketing, not certainty.

How The $1390 Payment Would Be Paid Out

Assuming for a moment that IRS Confirms $1390 Direct Deposit Payments eventually lines up with a genuine program, the method of payment is the one area where there’s almost no debate. The federal system has been moving steadily away from paper for years. Direct deposit is faster, cheaper to administer and generally safer than physical checks.

So in any realistic scenario, here’s how things would work:

- Taxpayers with bank details already used for refunds would be first in line.

- Social Security, SSI and SSDI recipients with electronic deposits would likely receive funds in the same accounts.

- People without direct deposit info might receive either a paper check or a prepaid debit card at their registered address.

Because of that, the smartest step you can take right now regardless of whether IRS Confirms $1390 Direct Deposit Payments materialises is to make sure you’re banking and mailing details are current, both on your latest tax return and in any benefit portals you use.

Red Flags and Scam Warnings Around The $1390 Direct Deposit Payments Headline

Whenever a specific dollar amount goes viral, scammers aren’t far behind. The $1,390 story is already being used as bait in emails, text messages and social DMs that claim to “fast‑track” your deposit or “pre‑enrol” you into IRS Confirms $1390 Direct Deposit Payments if you just click a link. The moment you do, you’re often taken to a fake portal that asks for your Social Security number, card details or online banking login.

To protect yourself, keep a few hard rules:

- Never trust payment promises that arrive as a random message with urgent or emotional language.

- Never share personal or banking details through links that do not clearly belong to official government domains.

- Never pay a “processing fee” or “unlock charge” to receive any federal stimulus or tax benefit legitimate programs do not work that way.

If something sounds too good, too rushed, or too secret to be real, treat it as a red flag until you’ve checked it through trusted official channels.

Gas Prices in 2025 In USA State-by-State: Is Your State Among the Most Expensive?

Practical Steps You Can Take Now

Even if the buzz around IRS Confirms $1390 Direct Deposit Payments never turns into a full‑scale, signed‑off program, there are practical moves that will help you with any future relief, refunds or credits:

- File your tax return on time and ensure all information is complete and accurate.

- Opt for direct deposit for any refund; this puts your bank details in place ahead of any future payments.

- Keep your address and contact details updated so important letters don’t vanish into old mailboxes.

- Learn where to log in to your official tax or benefit accounts so you can track real deposits, not rumors.

This way, if a genuine $1,390 payment or any other relief measure does receive full approval, your side of the process will already be in order, and you won’t be scrambling to fix errors while everyone else is getting paid.

FAQs on IRS Confirms $1390 Direct Deposit Payments

Is the IRS really sending $1390 to everyone?

No confirmed federal program currently guarantees a $1,390 payment to every American.

Who would likely qualify if a $1390 payment is approved?

If such a program is ever signed into law, eligibility would probably be based on your latest tax return, with full amounts for lower‑income households and phase‑outs for higher earners.

How would I actually receive a $1390 direct deposit?

Most people would be paid in the same way they receive refunds or federal benefits now directly into a checking or savings account on file.

How can I avoid scams related to the $1390 payment?

Ignore unsolicited texts, emails or messages that promise quick access to IRS Confirms $1390 Direct Deposit Payments in exchange for personal or banking information.