If you have always pictured your retirement starting neatly at 67, it is time to rethink that plan, because “Goodbye to Retiring at 67 in United States” is quickly becoming the new reality for millions of workers. As Social Security rules evolve, the age for full benefits is shifting, penalties for claiming early are getting steeper, and new proposals could push the full retirement age even higher in the coming years. “Goodbye to Retiring at 67 in United States” is not just a catchy headline; it signals a deeper change in how long Americans may need to work and how carefully they must time their Social Security claims.

“Goodbye to Retiring at 67 in United States” captures two big moves at once: first, the long‑planned shift of the Full Retirement Age (FRA) up to 67 for people born in 1960 and later, and second, new plans on the table to push that age beyond 67 for younger generations. For those born in 1959, the FRA jumps to 66 years and 10 months, while everyone born in 1960 or after must now wait until 67 to receive 100 percent of their earned Social Security benefit. At the same time, proposals from policy groups and lawmakers would gradually raise the FRA toward 69 in the 2030s, meaning today’s younger workers may not see full benefits until closer to age 70.

Table of Contents

Goodbye to Retirement at 67

| Point | Current / Proposed Situation |

|---|---|

| Full Retirement Age Today | 67 for those born in 1960 or later; 66 years 10 months for 1959 births as of 2025. |

| Early Claiming Age | Still 62, but with up to roughly 30 percent permanent reduction when FRA is 67. |

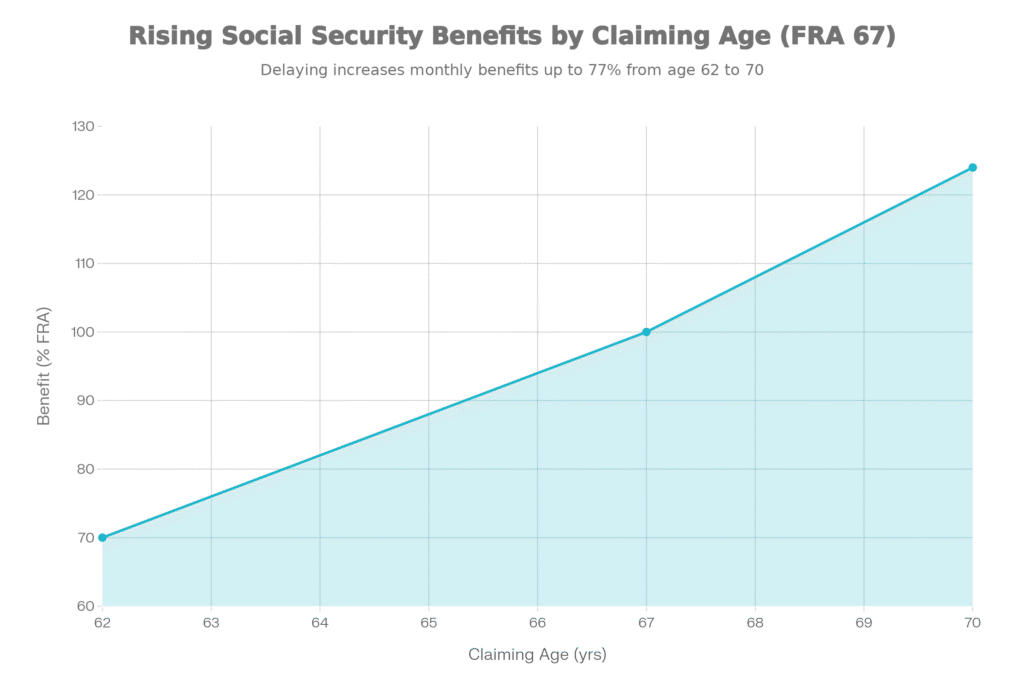

| Delayed Retirement Credits | Waiting past FRA up to age 70 can increase payments by about 8 percent per year, around 24 percent more at 70. |

| New Reform Proposals | Some plans would raise FRA from 67 toward 69 over time, mainly affecting younger workers. |

| Main Reason for These Changes | Longer life expectancy, large waves of retirees, and projected Social Security funding gaps. |

| Impact On Traditional Retirement | Makes it harder to rely on 65–67 as a “universal” retirement age for full benefits. |

What Exactly Changed For Social Security

The shift did not start yesterday. It traces back to reforms from the 1980s that slowly moved the FRA from 65 up toward 67 over many decades. Those changes are now hitting real people in a visible way, because the 1959 and 1960 birth cohorts are entering their mid‑60s and discovering that their “normal” age is later than that of older coworkers or siblings. Someone born a few years earlier can still reach full benefits sooner, even with a similar work and earnings history.

From 2025 onward, anyone born in 1960 will turn 65 but still need to wait two more years to reach their full retirement age at 67. That pushes more of the financial burden onto private savings, pensions, or continued work, because locking in full Social Security at 65 is no longer available for this group. For workers who grew up hearing that they could retire comfortably at 65 or 67, “Goodbye to Retiring at 67 in United States” effectively means they now have to decide whether to work longer, accept smaller checks, or redesign their income strategy.

How Claiming Age Changes Your Monthly Check

The basic structure of Social Security still follows three anchor ages: early, full, and delayed. You can claim as early as 62, at your full retirement age, or any time after FRA up to 70. What changed is the FRA itself. When your FRA is 67, taking benefits at 62 can cut your monthly check by roughly 30 percent for life. For example, if your full benefit at 67 would be 1,000 dollars per month, claiming at 62 might reduce it to somewhere near 700 dollars, and that lower amount stays with you permanently.

On the other hand, waiting beyond 67 earns delayed retirement credits that increase your benefit by about 8 percent for each year you delay up to age 70. Using the same 1,000‑dollar base, waiting until age 70 can raise your monthly benefit to roughly 1,240 dollars, which is around a 24 percent increase. Instead of assuming a fixed “right” age, you are now choosing between getting smaller checks for more years or larger checks for fewer years. That is the core of the new claiming strategy behind “Goodbye to Retiring at 67 in United States.”

Why Policymakers Want To Push Beyond 67

Behind all the headlines and political debates is a simple problem: more retirees, longer lives, and strained Social Security finances. A growing share of the population is over 65, and people are, on average, spending more years in retirement than when the system was first created. At the same time, payroll tax contributions from today’s workers must support both current retirees and the promises made for the future.

Raising the full retirement age again is one of the most frequently discussed levers to help close projected funding gaps. It is often presented alongside other ideas like adjusting payroll tax caps, changing cost‑of‑living formulas, or modifying how benefits are calculated for higher earners. For younger workers, this means that “Goodbye to Retiring at 67 in United States” could be just the beginning, with their own full retirement age sliding closer to 69 unless other solutions are chosen instead.

Who Will Feel The Impact Most

Not everyone is affected equally by these shifts. People who are already retired, or very close to retirement, are usually shielded in most proposals, so their full retirement age and current benefits remain largely unchanged. The groups that feel the impact most include:

- Workers born in 1959 and 1960, who are the first to live with an FRA at 66 years 10 months and then 67.

- Individuals now in their 30s, 40s, and early 50s, who could see their own FRA rise further if new rules are passed.

- People in physically demanding or high‑stress jobs such as health care workers, construction workers, warehouse staff, drivers, and service workers who may struggle to keep working full‑time into their late 60s.

For these workers, the concept of a single, clear retirement age is fading. Instead, they need a flexible plan that might include partial retirement, a shift to lighter or part‑time work, or higher savings earlier in life to maintain options later. “Goodbye to Retiring at 67 in United States” for them is less about a date on a calendar and more about building a cushion that lets them choose when and how to slow down.

How To Plan Smart In This New Retirement Landscape

In this environment, the most powerful step you can take is to know your own numbers and not rely on generic assumptions. Checking your online Social Security account (or creating one) lets you see your projected benefits at 62, your full retirement age, and 70, based on your actual earnings history. That gives you a starting point to test different scenarios and see how your choices affect your monthly income.

The next step is to coordinate Social Security with the rest of your financial picture. That means looking at your 401(k) or similar workplace plan, IRAs, savings, home equity, and even potential part‑time work. For some people, delaying Social Security while drawing from savings can maximize lifetime income; for others, claiming earlier while working part‑time may be more comfortable and realistic. The goal is not perfection, but a plan that fits your health, your family situation, and your risk tolerance.

Goodbye To Retirement At 67 In United States And Your Long‑Term Strategy

- “Goodbye to Retiring at 67 in United States” should not be read as a message of doom, but as a warning that the old one‑size‑fits‑all model is disappearing. Instead of aiming blindly at an age that may no longer match the rules, you can approach retirement as a phased process: perhaps reducing hours in your early 60s, delaying Social Security until it makes sense, and using multiple income sources to smooth the transition.

- The more you understand the new Social Security rules, the less likely you are to be surprised by benefit cuts or delayed eligibility. Building a realistic savings plan, staying employable with skills that can support part‑time or flexible work, and reviewing your projections every few years can help you stay in control even as the official retirement age shifts. In the new reality of “Goodbye to Retiring at 67 in United States,” informed planning is your best defense and your best opportunity to design a retirement that still feels secure and on your terms.

FAQs on Goodbye to Retirement at 67

1. What does “Goodbye to Retiring at 67 in United States” actually mean?

It means that the traditional idea of 67 as a safe, fixed age for full Social Security benefits is fading, especially for people born in 1960 or later and younger generations who may face an even higher full retirement age in future reforms.

2. Can I still retire and claim Social Security at 62?

Yes, you can still claim Social Security at 62, but your monthly benefit will be permanently reduced compared with waiting until your full retirement age or age 70, so you need to decide if smaller checks for more years fit your situation.

3. Will everyone be forced to work past 67 now?

No, you are not legally forced to work past 67, but higher full retirement ages and steeper early‑claiming cuts mean many people may choose to work longer or combine part‑time work with Social Security to maintain their standard of living.

4. Who is most affected by the higher retirement age?

People born in 1959 and 1960, younger workers now in their 30s and 40s, and those in physically demanding jobs are most exposed, because they either face the new full retirement age already or are likely to be targeted by any future increases.