In 2025, Wells Fargo announced a substantial settlement reaching up to $5,000 for customers impacted by illegal telemarketing practices. However, eligible claimants must act swiftly—applications close on April 11, 2025. This article outlines how to determine your eligibility and what steps to take before time runs out.

Table of Contents

$5,000 Wells Fargo Settlement 2025

| Key Fact | Detail |

|---|---|

| Settlement Total | $19.5 million |

| Eligibility Period | October 22, 2014 – November 17, 2023 |

| Deadline to Submit Claim | April 11, 2025 |

| Maximum Payout | Up to $5,000 per eligible claimant |

| Claim Method | Online claims portal or mail-in submissions |

What Is the $5,000 Wells Fargo Settlement?

The $5,000 Wells Fargo Settlement 2025 refers to a class-action legal agreement, with Wells Fargo agreeing to pay $19.5 million to resolve claims related to illegal telemarketing practices. Specifically, the lawsuit addressed calls that were made to consumers without the proper disclosures required by law, including calls that were recorded without prior consent.

The claims date back to October 22, 2014, and continue until November 17, 2023, impacting customers who received telemarketing or promotional calls in violation of California’s privacy laws. The settlement offers compensation to individuals who were affected by these illegal calls.

Why Was Wells Fargo Sued?

Wells Fargo’s legal troubles stem from accusations that the bank made telemarketing calls to customers without providing necessary disclosures. Under California’s privacy laws, companies must inform consumers when their calls are being recorded. Failing to do so can lead to serious legal consequences, including the kinds of actions seen in this case.

The class-action lawsuit alleged that Wells Fargo’s failure to provide proper notice to consumers during certain telemarketing campaigns resulted in a violation of state law. The settlement, which comes after years of litigation, is designed to compensate individuals who were subjected to these recorded calls without consent.

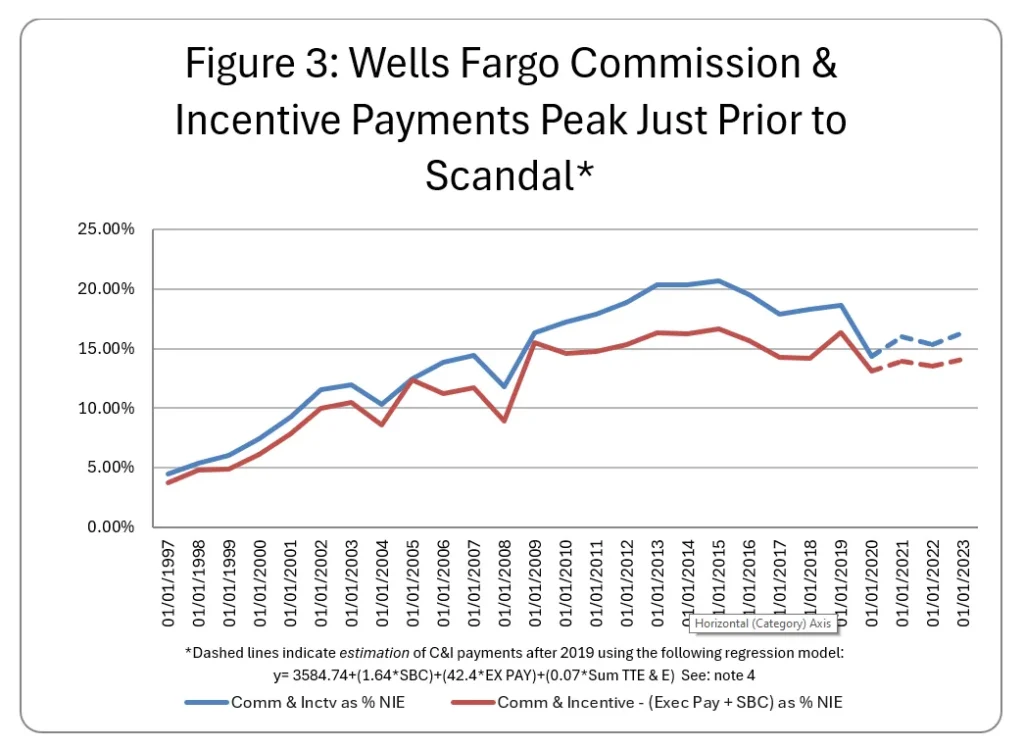

A History of Legal Issues: Wells Fargo’s Legacy of Settlements

Wells Fargo has faced a series of legal and regulatory challenges in recent years. From the fake accounts scandal in 2016 to issues surrounding unauthorized fees and telemarketing practices, the bank has been under intense scrutiny from both regulators and customers alike. This $19.5 million settlement is another chapter in the ongoing saga of Wells Fargo’s efforts to resolve customer grievances.

While the settlement provides financial compensation to affected individuals, it also underscores the need for the bank to reform its business practices, especially in customer interactions. Legal analysts suggest that Wells Fargo’s history of settlements serves as a reminder of the need for strict adherence to consumer protection laws.

Who Is Eligible for the $5,000 Wells Fargo Settlement 2025?

To be eligible for the $5,000 Wells Fargo Settlement, you must meet several key criteria:

- Residency Requirement: You must be a resident of California, or a California-based business, as the settlement applies to individuals affected by Wells Fargo’s telemarketing practices in that state.

- Affected by Illegal Telemarketing: You must have received telemarketing or promotional calls from Wells Fargo that were recorded without consent during the period from October 22, 2014, to November 17, 2023.

- Filed a Claim: The most crucial factor is whether or not you have submitted a claim. Claims must be filed by April 11, 2025, and you must be able to provide relevant documentation to verify that the calls you received qualify for compensation.

If you meet the eligibility requirements and submit a claim by the deadline, you may be eligible for compensation based on the number of recorded calls you received during the specified period.

How Much Compensation Could You Receive?

The settlement is structured to compensate individuals based on the number of recorded telemarketing calls they received without proper notice. Each qualifying call typically results in $86 in compensation, though amounts can vary.

If you were the recipient of multiple calls during the eligibility period, your total payout could increase significantly. In some cases, claimants have reported receiving compensation as high as $5,000.

It is important to note, however, that the total settlement amount will be distributed among all eligible claimants. Therefore, the exact payout depends on the number of claims filed and the total number of qualifying calls.

Submit a Claim For $5,000 Wells Fargo Settlement 2025

To receive compensation under the $5,000 Wells Fargo Settlement, eligible individuals must submit a claim. There are two main methods for submitting a claim:

- Online: The fastest method for submitting a claim is through the official online claims portal. This portal allows you to quickly enter your details and submit your claim. It also provides a convenient way to track the status of your claim.

- Mail-in: For those who prefer not to use the online system, Wells Fargo has also provided the option to submit claims by mail. Claimants can download the claim form from the settlement website, fill it out, and mail it to the specified address.

The deadline for submitting claims is April 11, 2025, and it is critical that all claims be submitted before this date. Claims received after this date will not be processed.

$5,000 Wells Fargo Settlement 2025 Deadlines and Key Dates

| Event | Date |

|---|---|

| Eligible Recorded Call Period | October 22, 2014 – November 17, 2023 |

| Claim Submission Deadline | April 11, 2025 |

| Court Approval Hearing | May 20, 2025 |

| Payments Mailed | Late 2025 |

Claimants must ensure they file their claims before the April 11, 2025 deadline to be considered for compensation. Late claims will not be accepted.

Expert Opinion: Consumer Protection Perspective

Dr. Linda J. Morrison, a professor of law and consumer rights advocate at the University of California, explains, “This settlement marks an important moment for privacy rights in the digital age. Telemarketing practices like these erode trust, and settlements like this are essential for restoring consumer confidence.”

While Dr. Morrison applauds the settlement, she also emphasizes that consumers must remain vigilant. “This case shows that even large institutions like Wells Fargo must be held accountable for their actions. However, it also highlights the ongoing challenges of privacy in our digital communications landscape,” she adds.

Payment Distribution

Once claims are processed and approved, Wells Fargo will begin distributing the settlement funds. Payments will be made either via check or electronic deposit, depending on the claimant’s preference.

The payments are expected to be distributed throughout late 2025, with most recipients receiving their checks by the end of the year. If you have already filed a claim and are eligible, you will not need to take any additional action.

Safeguard Against Future Violations

In light of this settlement, consumers may want to take proactive measures to protect themselves from similar issues in the future. Opting out of telemarketing or adding your number to the National Do Not Call Registry can significantly reduce the likelihood of receiving unsolicited calls. Additionally, consumers should remain cautious when sharing personal information over the phone and ensure that any call they receive is legitimate.

Related Links

IRS Finally Approves $2,000 Direct Deposit: Payments to Begin December 18

Alternatives or Additional Resources

If you did not receive a settlement check or if you believe your payment amount is incorrect, Wells Fargo has set up a customer support hotline and an online portal for individuals to inquire about the status of their claims. Additionally, if you were impacted but didn’t file a claim, you may be eligible for future settlements in related cases or similar legal actions.

Act Now Before It’s Too Late

The $5,000 Wells Fargo Settlement 2025 offers an important opportunity for eligible individuals to claim compensation for illegal telemarketing practices. However, to take advantage of this settlement, eligible customers must act quickly. With the April 11, 2025 deadline approaching, there is limited time to file a claim.

If you believe you are eligible for compensation, visit the official settlement website and submit your claim before the deadline. Ensure your documentation is accurate and complete to avoid delays.